By: Joshua Howgego

Send to a friend

The details you provide on this page will not be used to send unsolicited email, and will not be sold to a 3rd party. See privacy policy.

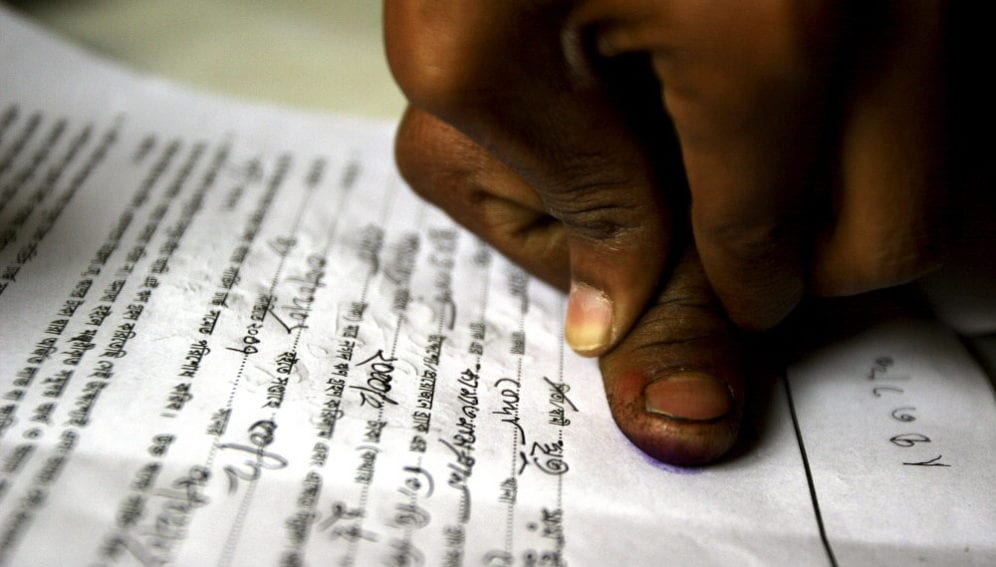

Microfinance — the practice of providing small loans to poor people — is insufficient to quickly and permanently move people out of poverty, according to studies reported last month. [1]

While this sounds damning, criticism of microfinance can be far more cutting. For instance, in 2010, Bangladesh’s Prime Minister Sheikh Hasina reportedly said that microcredit provider the Grameen Bank was “sucking blood from the poor in the name of poverty alleviation”. [2]

The idea behind microfinance is that developing world entrepreneurs often only need a small chunk of credit to expand their businesses and work their way out of poverty.

Rupert Scofield, the CEO of microfinance firm Finca, believes in this ideal. But he tells me new technologies are disrupting the sector, and may explain some of the bad rap that microfinance appears to be receiving.

Finca operates using a traditional ‘legacy’ model, Scofield says. This means it knows all its clients. “We have teams of credit officers that get out there, interact with them and learn about their problems.”

These efforts mean the firm is confident that clients can repay loans, but they also mean Finca has to charge interest of at least 17 per cent — sometimes as much as 30 per cent for new customers — to make a small profit, Scofield says. (The firm operates worldwide and rates vary between countries.)

The rise of mobile and online banking is shaking up the model. Scofield says new firms track the online and mobile banking behaviour of developing world citizens. By compiling a data-rich profile of how customers handle money, these firms can understand their needs and send them text messages offering specially tailored financial products that can often be accepted just by returning the text.

Because this model works remotely, the firms can charge interest of as little as ten per cent, with most of that being profit, says Scofield. “Since it’s all digitised, there are not many humans in that model that you have to put on a pay roll or pay for their travel.”

But Scofield thinks this remote approach to customer approval fails to ensure clients can repay loans. Providers have made the loans available to masses of people with only scant background checks in an “unbridled drive for profit,” he says.

He blames the resulting competitive environment, rather than microfinance in itself, for a spate of deaths in 2010 linked to pressure to pay back microfinance loans that tarnished the sector’s reputation. [3]

“Microfinance is a bit like a knife,” he says. “It’s a tool. You can use it to spread butter or you can stick it into someone.”

“Providers have made the loans available to masses of people with only scant background checks in an “unbridled drive for profit.”

Rupert Scofield

Scofield sees the remote model sticking around, and indeed admits his firm is looking for ways to partner with some of them to survive in the new business climate.

He thinks the solution lies in regulation. But that’s tough for two reasons. First, technology is changing so quickly that it is hard for any rulebook to keep up. Second, with the public mood against microfinance, Scofield worries that populist politicians might end up twisting guidelines to make business impossible.

One way forward could be a working group of microfinance CEOs in which he is a member. The consortium is working on guidelines for responsible practice in the sector, which would include principles such as being focused on client needs and creating measureable value for them. Scofield hopes the guidelines could help mould the sector back to its more ethical roots — though it is unclear as yet precisely how this would be achieved.

Joshua Howgego is SciDev.Net’s deputy news and opinions editor. @jdhowgego

See below for a video about a week in the life of Rupert Scofield:

References

[1] Tom Murphy Microfinance not a quick escape from poverty, studies show (Humanosphere, 22 January 2015)

[2] Fund transfer allegation against Prof Yunus needs inquiry: PM (The Financial Express, 6 December 2010)

[3] Soutik Biswas India's micro-finance suicide epidemic (BBC News, 16 December 2010)