Send to a friend

The details you provide on this page will not be used to send unsolicited email, and will not be sold to a 3rd party. See privacy policy.

[YAOUNDE] A disaster risk insurer that resulted from a specialised agency of the African Union (AU) plans to start an insurance cover for outbreaks of diseases such as Ebola in Sub-Saharan Africa by 2017.

The African Risk Capacity (ARC) Insurance Company Limited, which was formed in 2013 as the financial affiliate of its predecessor, the ARC Agency, has traditionally focused on providing insurance cover for victims of disasters, but now hopes to add disease outbreak insurance to its services.

“Outbreak and epidemic insurance would be priced based on the country's risk.”

Richard Wilcox, The African Risk Capacity(ARC)

“As in the case of natural disasters, [disease] outbreaks create immediate funding requirements for African governments, which traditional foreign aid only addresses on an ad hoc basis and often [in] untimely manner,” says a statement announcing the insurance released by the ARC last month (2 February).

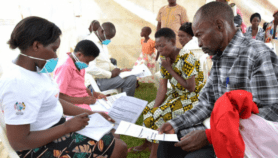

Richard Wilcox, ARC’s founding director-general, says the ARC Insurance Company Ltd, which has its head office in Bermuda, hopes to insure first four African countries in 2017.

He tells SciDev.Net that the current system is not suitable for timely and equitable disbursement of funds when disasters strike, and that with the proposed insurance, African countries will “move from managing crises to managing risks, [and] protecting vulnerable populations through early intervention”.

ARC’s insurance scheme hopes to help countries develop interventions to tackle outbreaks such as the continuing Ebola, which according to the WHO figures released yesterday (24 March), has killed 10,311 people in Guinea, Liberia and Sierra Leone.

Wilcox adds that it is possible to determine from current data and analytics what reservoir of viruses exist in a given country and the probability of transfer to the human population, as well as how likely transmission could be based on several different factors.

“Outbreak and epidemic insurance would be priced based on the country's risk. Similar to slow onset natural disasters like drought, pandemics don't ‘hit’; they develop over time and there are mitigating measures that can be taken for, which ARC Ltd would provide financing before they become pandemics,” he explains.

Although initial funding of about US$300 million is expected to come from donors, Wilcox believes that it is possible for African countries to sustain the insurance scheme.

According to Wilcox, outbreak and epidemic insurance could enable governments save up to 50 per cent of the cost of managing such disasters as countries who subscribe to the scheme share the risks.

Health experts agree. “We can only plan for health emergencies by ensuring that there is secure financing,” says Elvis Ndansi, a Cameroon-based health policy expert. “I think a health emergency fund for Africa would be a wonderful solution to most of the health problems facing the continent.”

Ndansi adds that the impacts of epidemics such as Ebola and SARS could have been significantly scaled down had such a financing scheme existed.

This article has been produced by SciDev.Net's Sub-Saharan Africa desk.